APA Style

Alexander Voronov. (2025). On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk. Sustainable Processes Connect, 1 (Article ID: 0015). https://doi.org/Registering DOIMLA Style

Alexander Voronov. "On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk". Sustainable Processes Connect, vol. 1, 2025, Article ID: 0015, https://doi.org/Registering DOI.Chicago Style

Alexander Voronov. 2025. "On the Added Value Conception for the Implementation Instruments Towards Sustainability of the Markets with Carbon Risk." Sustainable Processes Connect 1 (2025): 0015. https://doi.org/Registering DOI.

ACCESS

Research Article

ACCESS

Research Article

Volume 1, Article ID: 2025.0015

Alexander Voronov

Voronov.a@unecon.ru

Saint Petersburg State University of Economics, Saint Petersburg, 191023, Russia

Received: 22 Feb 2025 Accepted: 18 Sep 2025 Available Online: 22 Sep 2025

The key component in achieving the efficient carbon management, which involves mitigating the vast majority of carbon dioxide emissions in balance with carbon dioxide utilization technologies, is market sustainability implementation. At the same time, a value-added model is used, which forms the basis for determining carbon risk.

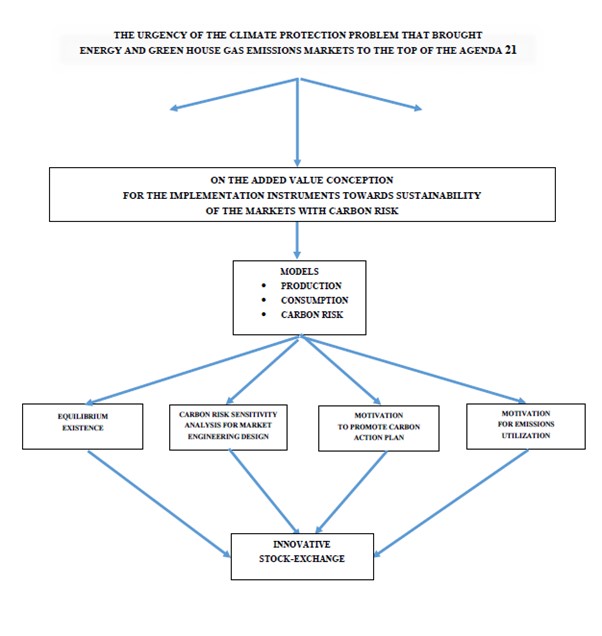

We`ve undertaken the multi criteria modelling for analytical approximation of product life cycle, based at the wide area of parameters for control and optimization, in particular: (1) the quantitative assessments for the balance existence at the market of product with carbon risk; (2) the quantitative scheme for carbon risk sensitivity analysis; (3) the conditions for production and consumption participants being the motivation to promote sustainability; (4) the relationship between waste utilization costs and technology efficiency being the motivation for carbon dioxide emissions minimization; (5) the innovative stock-exchange under the sustainability criteria.

The practical prospects for the sustainability management of the product with carbon risk, including the energy markets, are seen via the vector optimization technique, while the represented quantitative indicators are well providing market participants with strong base for decision making along the environmental management.

The proposed model approach (carbon risk, managed market, innovative stock-exchange) provides the novelties for environmental management under the sustainability criteria.

Disclaimer : This is not the final version of the article. Changes may occur when the manuscript is published in its final format.

We use cookies to improve your experience on our site. By continuing to use our site, you accept our use of cookies. Learn more